You ever see twin sisters hanging out together and just by looking at one of them you can tell one of them is a little more put together? She just carries herself a little better, seems to have more confidence, a little more charisma. Then you meet them and you realize that the one that carried herself a little better seemed a little more high maintenance than her sister.

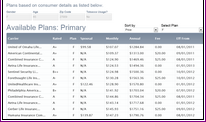

Meet Medicare supplement plan F and Medicare supplement plan G. At first glance, plan F is the clear cut winner. They both provide excellent coverage of gaps in regular Medicare coverage. In fact, plan F covers all the deductible, coinsurance, co-pay, and excess charge gaps in Medicare so that with this plan you should not have to pay out-of-pocket for medical expenses. Plan G, works nearly identically (hence the twin analogy) but does not cover the Medicare part B deductible, which is your outpatient services (doctors visits, etc).

So, why would someone want to go with plan G over plan F? Easy. It costs less. In fact, in many cases you can save enough over the course of the year to be able to cover your part B deductible ($162 in 2011) and still come out ahead by up to $100 a more for the year.

Also, as you get older the difference in price tends to get a little more noticeable. You could eventually see a $200 or more saving each year on a plan G (after you've met the Part B deductible).

So, you might not have the absolute best equipped Medicare supplement with plan G but you'll get the best value from plan G (combination of benefits and premium) in most cases.

As you go down the lesser travel path in researching the viability of plan G you might be shocked to find that you, more often than not, come out ahead with plan G. More bang for the buck. You might realize that even after paying the part B deductible yourself you end up saving $100 or more with plan G. That might not seem like a lot to a lot of people but when you're retired and on a fixed income every hundred dollars counts.

So, the next time you're looking to compare Medicare Supplement Insurance plans be sure to not leave plan G out of your research because she just doesn't look as good as plan F. She might ultimately be more of a keeper.

No comments:

Post a Comment