You ever see twin sisters hanging out together and just by looking at one of them you can tell one of them is a little more put together? She just carries herself a little better, seems to have more confidence, a little more charisma. Then you meet them and you realize that the one that carried herself a little better seemed a little more high maintenance than her sister.

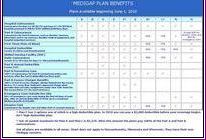

Meet Medicare supplement plan F and Medicare supplement plan G. At first glance, plan F is the clear cut winner. They both provide excellent coverage of gaps in regular Medicare coverage. In fact, plan F covers all the deductible, coinsurance, co-pay, and excess charge gaps in Medicare so that with this plan you should not have to pay out-of-pocket for medical expenses. Plan G, works nearly identically (hence the twin analogy) but does not cover the Medicare part B deductible, which is your outpatient services (doctors visits, etc).

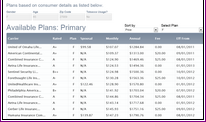

So, why would someone want to go with plan G over plan F? Easy. It costs less. In fact, in many cases you can save enough over the course of the year to be able to cover your part B deductible ($162 in 2011) and still come out ahead by up to $100 a more for the year.

Also, as you get older the difference in price tends to get a little more noticeable. You could eventually see a $200 or more saving each year on a plan G (after you've met the Part B deductible).

So, you might not have the absolute best equipped Medicare supplement with plan G but you'll get the best value from plan G (combination of benefits and premium) in most cases.