Living on a fixed income is challenging, to say the least. When sudden financial needs come up, like unexpected trips to the hospital or expensive new prescriptions, will financial chaos erupt? So, how do you figure out which Medicare supplement insurance, also known as "Medigap" insurance, is best for you?

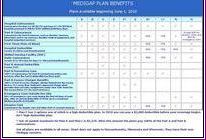

Supplemental insurance providers are required by law to offer no more than 14 plans, with each plan covering specific expenses. Information is available for 12 standard Medicare supplement insurance plans. It's important to take your time and shop around to get the plan that is best for you, that best serves your needs.

You need to understand what Medicare covers so you can figure out what you need in the way of supplemental insurance coverage. Medicare costs include Part B (doctor) costs, Part B deductible, Part A (hospital) costs, Part A deductible, Part B extra charges, at home recovery, foreign travel emergency, skilled nursing home costs, prescription medication, blood work and preventive care.

Determine what you need and can afford. Coverage for a healthy individual will be different than someone with a pre-existing condition. Ask questions to clearly understand what is available and what you need. Recently something new has been offered called Medicare Advantage. These plans may or may not have a premium to pay. You can opt for the no premium plan for lesser coverage or go for the premium plan that will cover more.

When you buy a Medigap policy, you must have Medicare Part A and Part B for which you will pay $93.50 (in 2007) per month. Medigap insurance must follow federal and state laws which protect the consumer. The front of a Medigap policy must clearly identify it as "Medicare Supplement Insurance." Costs vary by company, but the coverage is similar.

Everyone who is eligible for Medicare also is guaranteed the right to buy a Medigap policy under certain circumstances. Spouses must buy a separate Medigap policy. For more information on Medigap policies, you may call 1l-800-633-4227 and ask for a free copy of the publication "Choosing a Medigap Policy: A Guide to Health Insurance for People With Medicare."

More information is available at your state health insurance assurance program and your state insurance department. Phone numbers for these departments and programs in each state can be found in the above publication.

No comments:

Post a Comment